Is innovation passion-driven?

November 25, 2018

CAS Digital Finance study tour London 8./9.11.2018 with Rino Borini, reported by Janne Fazio

The 6 elements needed for a region to bring out Fintech success are: talent, innovation, capital, market, innovative regulation and strong government support, all of these found in London. This makes the city “the home of Fintechs” and perfect destination of our study tour.

26 future digital rockstars turned up to be welcomed by Susanne Chishti and Rino Borini at the Accenture Innovation Lab. Susanne, who is CEO of FINTECH Circle, started with a brief global FINTECH overview, explaining the ecosystem and the FINTECH revolution, which is all about structural change as the core of financial services disrupted through new business models, changes in infrastructure and new value propositions.

Then we had the chance to visit the “Extented Reality” room in the Accenture Innovation Lab, a room used to demonstrate different virtual reality situations to Accenture clients. Henry grabbed the chance and dived into a virtual reality tour, first playing rugby and then teaching how to mix dangerous fluids in a pharma lab.

Virtual Reality Test

After lunch we met 4 Fintech startups and 1 Fintech scaleup and got a short overview of their ideas and business models:

HUBX

Axel Coustere & Stephen Ong, co-founders

HUBX is the premier capital raising and private placement solution for professionals. They aim to bring investors and providers together, specialised on the private placement market, helping to find the perfect match, creating a secondary market for non-listed companies.

ClearMacro

Mike Simcock, CEO

Founded in 2014 by a team of highly qualified professionals, ClearMacro aims to provide a centralised, data-driven investment engine to boost performance.

Innovate Finance

Rashee Pandey, Head of Partnership

Innovate Finance is an independent membership association with over 250 members, of which 200 are Fintechs. Innovate Finance is a non-profit company building a professional network for startups and scaleups. Also, they last year published a list of the 100 most powerful women in Fintech to push gender diversification within Fintech.

CityFALCON

Ruzbeh Bacha, CEO

Ruzbeh gave us a brief introduction on the way in which CityFALCON redefines financial news is sourced, distributed and consumed. He convinced the audience with both a fun and interesting presentation, his passion for the product offered was obvious.

Automata

Matthias Kurz, co-founder

Automata is a robo-advisor for crypto-currencies, soon to be live.

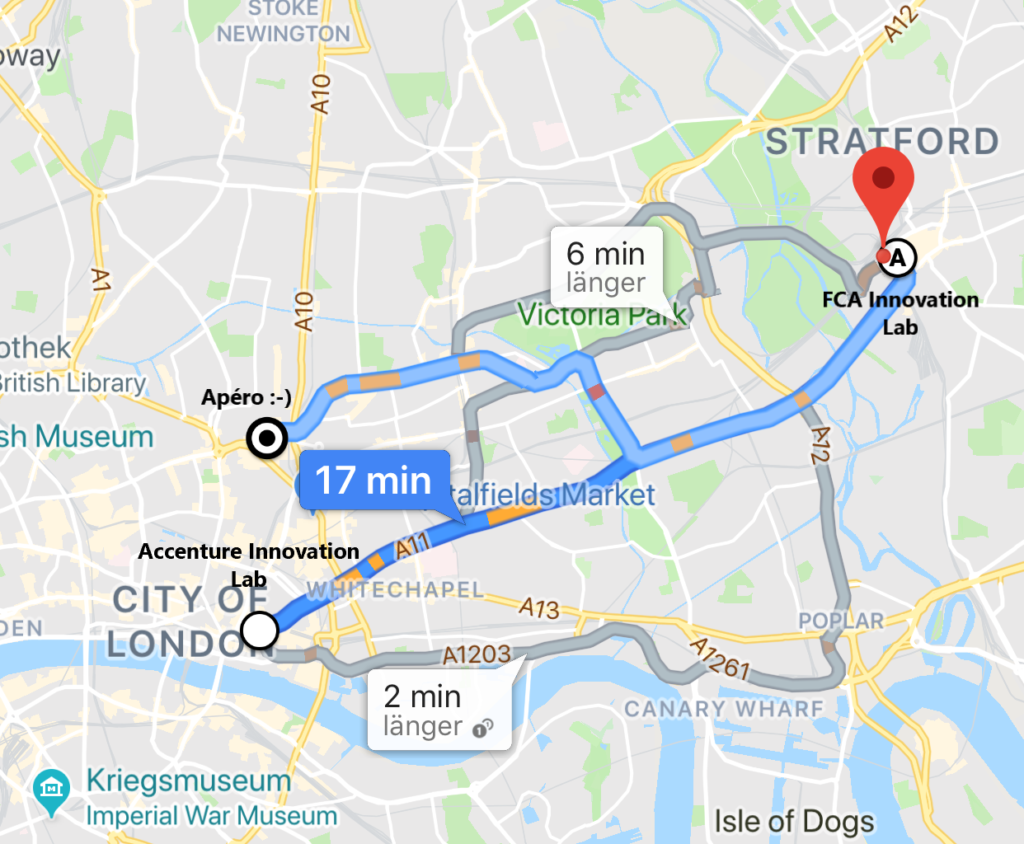

After the Automata presentation, we were off to visit the Financial Conduct Authority (FCA) Innovation Lab in Stratford. Kathrine Browne managed to bring some life back to the tired audience by guiding us through a both informative and interesting presentation of the main responsibilities of the FCA Innovation Lab. Most impressive was the open-minded attitude of an official body, as they try hard to focus on the opportunities new business models create rather than at the downsides. They have a close cooperation with Fintech startups, also provided through the globally copied “regulatory sandbox”, where startups are encouraged to work closely with the FCA on business models, risks and opportunities, regulatory requirements. The FCA is known to not over-regulate startups in order to encourage innovation.

Apéro time! Even future digital rockstars get tired and need a beer at some stage, pitstop at THE RELIANCE for refreshments! Followed by italian dinner at Bottega Prelibato with lots of interesting talks I do not want to provide deeper insights into here

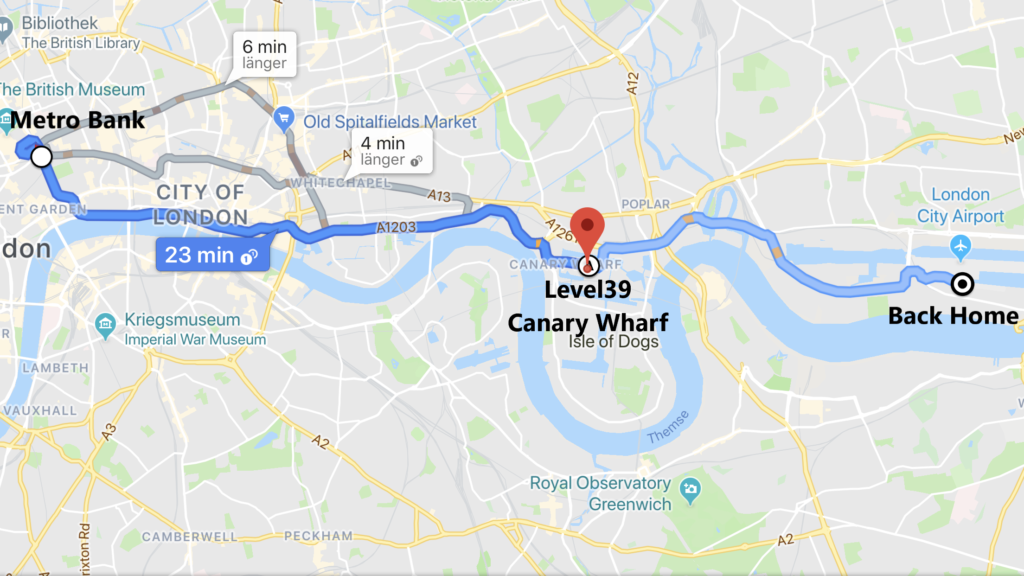

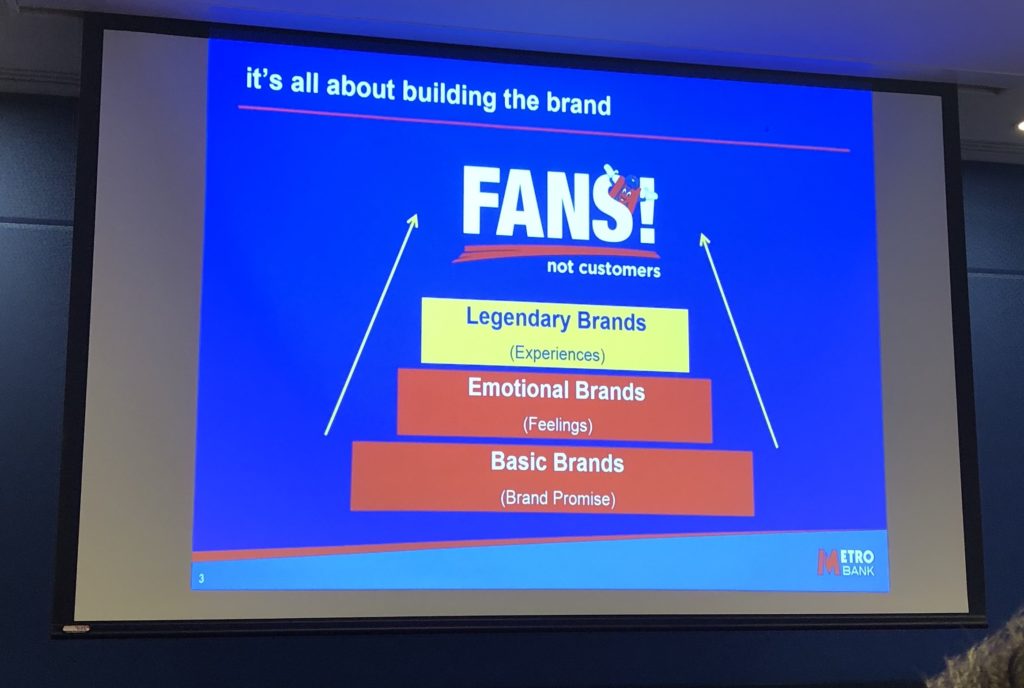

Friday morning started with a mind-rocking experience! We met at the Metro Bank branch at One Southhampton Row to be guided through a very non-traditional banking presentation! Well, I have to correct, Metro Bank does not see themselves as a Bank, but as a retailer, so a retailer-presentation. They do not have customers, they have fans! Andrew Richards managed to completely change my mind from when I walked into the bank and thought “I would never open an account here” as everything was loud (in colours!) and somehow felt a little like Disneyland, to convincing me of their very untraditional model within 30 minutes! I walked out as a fan They are completely service driven and many of their values are worth being considered by all of us. I really like statements such as “we take what we do very seriously, but we do not take ourselves that seriously”, or “smile-trial” as first priority to hire employees (“I can teach the employees to push the right buttons on the computer, but I cannot teach them to be nice”). Therefore, I can only recommend to everyone passing a Metro Bank branch, go inside and feel the experience!

Level39

Next stop is L39 at One Canada Square, Canary Wharf

L39 is a community of 1,250 leaders in cybersecurity, Fintech and retail tech. The 80,000 square foot community occupies 3 floors in the impressive building, helping businesses to achieve scale. All open space workstations are rented by startups and give access to world-class customers, talent and infrastructure. The following companies gave us a brief introduction to their business models:

UBS Blockchain talk

A UBS Innovation Lab manager talked about the priorities and new business models they are looking at in the UBS Innovation Lab. The focus is right now at AI, Blockchain, Data, Cloud and Experience. They are well aware of the fact that technology is not the problem, it’s the people and the culture that needs to be taken care of.

PORT.im

Julian Saunders, CEO

Connect, comply, communicate. PORT.im helps your business meet the requirements of the new General Data Protection Regulations. In a world with fast growing data, PORT.im offers great help to meet regulations. Julian demonstrated 4 simple steps to get GDPR compliant within hours: 1. connect your data, 2. get control of your data, 3. communicate with people, 4. control personal data.

Bankable

Juliette Marion & Maria Viera, Sales & Accountant Managers

“Banking as a service”, serving dominant financial institutions, corporates and Fintechs with payment solutions.

Bud

Jamie Campbell, co-founder

Bud provides an open banking layer between banks and financial service providers, combining APIs and data to create a new species of connected experience. Bud is the financial network that intelligently connects banks, Fintechs and customers together. And Bud is one of the 12 finalists in the Nesta Open up Challenge, we cross fingers they will win!

London, as home of Fintechs, was a great experience and we were all fascinated by the fast growing dynamic companies! We gained so many interesting insights, and I am more than convinced that innovation is passion-driven as with all the energy and enthusiasm demonstrated by the above mentioned innovators, felt like pure power! A special thanks to Susanne Chishti and Rino Borini for organising all these interesting meetings and presentations!

Unser Newsletter liefert dir brandaktuelle News, Insights aus unseren Studiengängen, inspirierende Tech- & Business-Events und spannende Job- und Projektausschreibungen, die die digitale Welt bewegen.